Beyond Cryptocurrencies:

The Strength of Fine Arts in the Digital Era

Welcome to the intersection of the digital and physical realms where creativity, innovation, and tradition blend seamlessly.

Discover the novel world of Fine Arts: a new horizon that combines the tangible allure of fine art with the transformative potential of blockchain technology.

Friday, 25 Aug 2023

6:30pm – 9:00pm

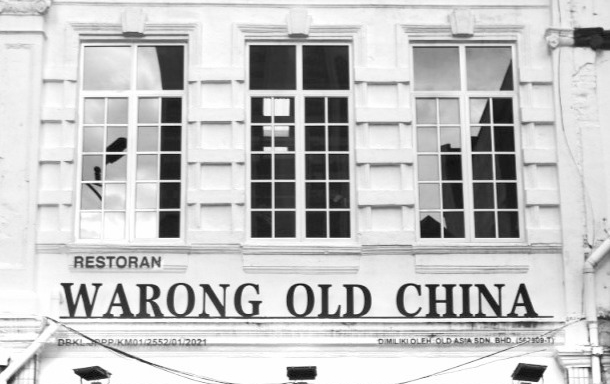

Warong Old China - Upperfloor, VIP Art Dining Area

144, Jalan Tun HS Lee, City Centre, Kuala Lumpur.

Guest Speaker

Join us in our passionate quest for appreciating and collecting fine arts. Unleash your inner collector with access to our exceptional resources, exclusive benefits, and a intersecting community between Web 3.0 and Traditional worlds that truly values the world of art.

Together with the supporting galleries, auction houses and private collectors will carefully curate artworks considering several criteria i.e. artist reputation, proven price records with accessible pricing.

Curated artworks can be bought using USDT (Ethereum Chain). All artworks comes with Certificate of Authenticity allowing buyers peace of mind from counterfeits.

Artworks are scheduled for private previews over a limited window at partner galleries. Make the purchase through our online catalogue and choose self pick-up or delivery.

Why Fine Art?

Art Basel and UBS Global Art Market Report: According to the 2020 edition, online sales of art reached a record high of $12.4 billion, doubling in value from the previous year. This illustrates the growing appetite for digital platforms in art transactions, a trend that Phygital NFTs could potentially capitalize on.

According to a study by Deloitte and ArtTactic, the art market showed resilience during the 2008 global financial crisis. From 2008 to 2009, while global equity markets experienced significant declines, the art market witnessed a moderate decline in sales but recovered relatively quickly in subsequent years.

Contemporary art has achieved an annual return of 14% over the last 25 years, as of December 2020, versus a 9.5% annual return from the S&P 500.

Art market has been last to decline and first to recover during recessionary periods 2008-09.

Contemporary art has achieved an annual return of 14% over the last 25 years, as of December 2020, versus a 9.5% annual return from the S&P 500.

The S&P 500 took four years to return to its pre-recession high from the low point, and this bounce-back occurred in under a year for the art market.